How do I use the Amortization tracker?

The Amortization Tracker allows you to track loans that are connected to your properties and separate interest from principal to help you with tax preparation.

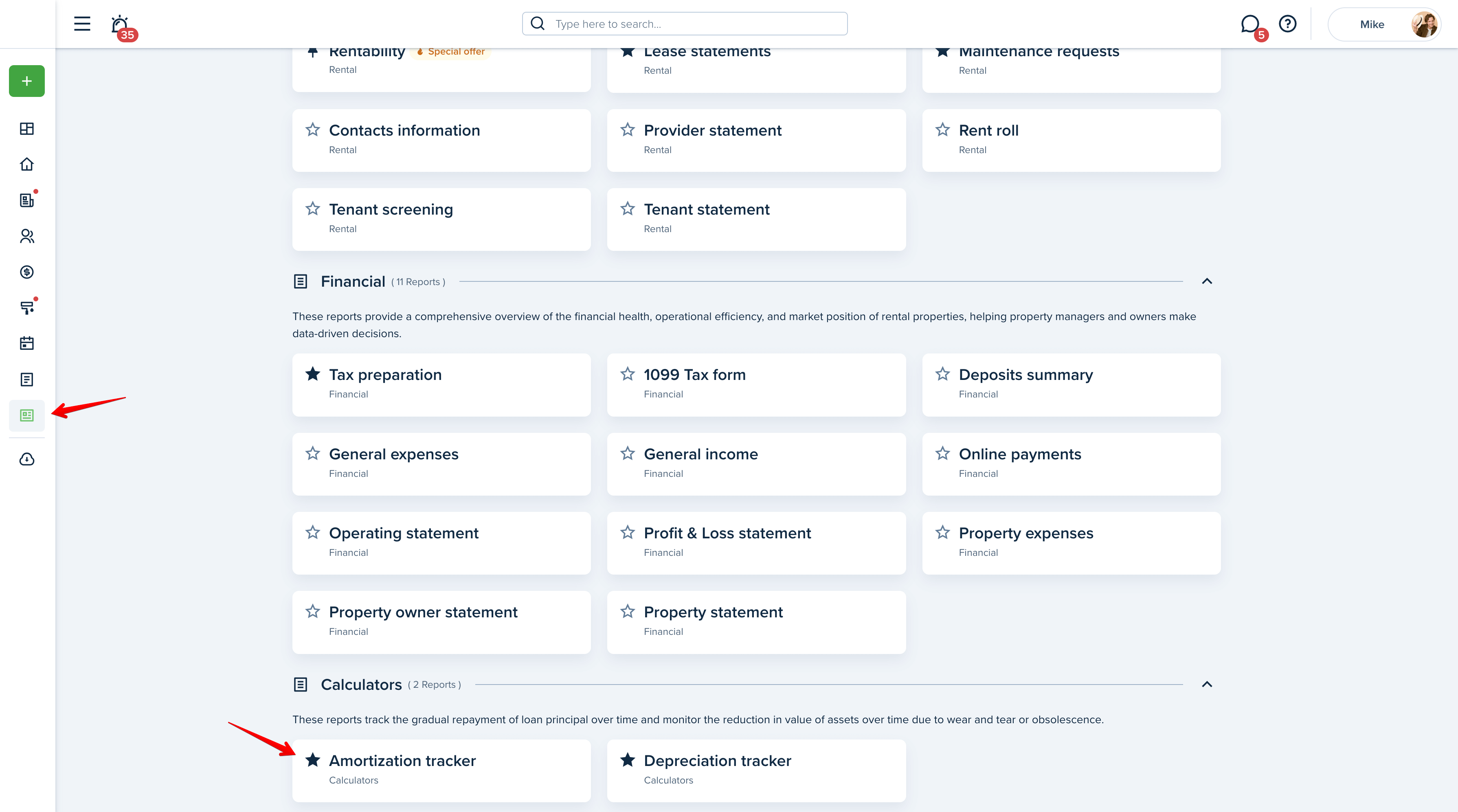

To access the Amortization Tracker, open the Reports page from the left-side menu. Here you can find the respective card in the Calculators section (if the “swimlane by type” is enabled) and will be able to mark a report as favorite to move it to the top of the section.

Icons in the top right corner of the page indicate the following:

Info Tip: Hover over it to read a brief amortization tracker description.

Sharing options: Hover over it to see if an owner has access to it.

Help: Click on this icon if you want to read the complete article on how to use this report.

Please note!

Check the pricing for the limits associated with your selected subscription plan.

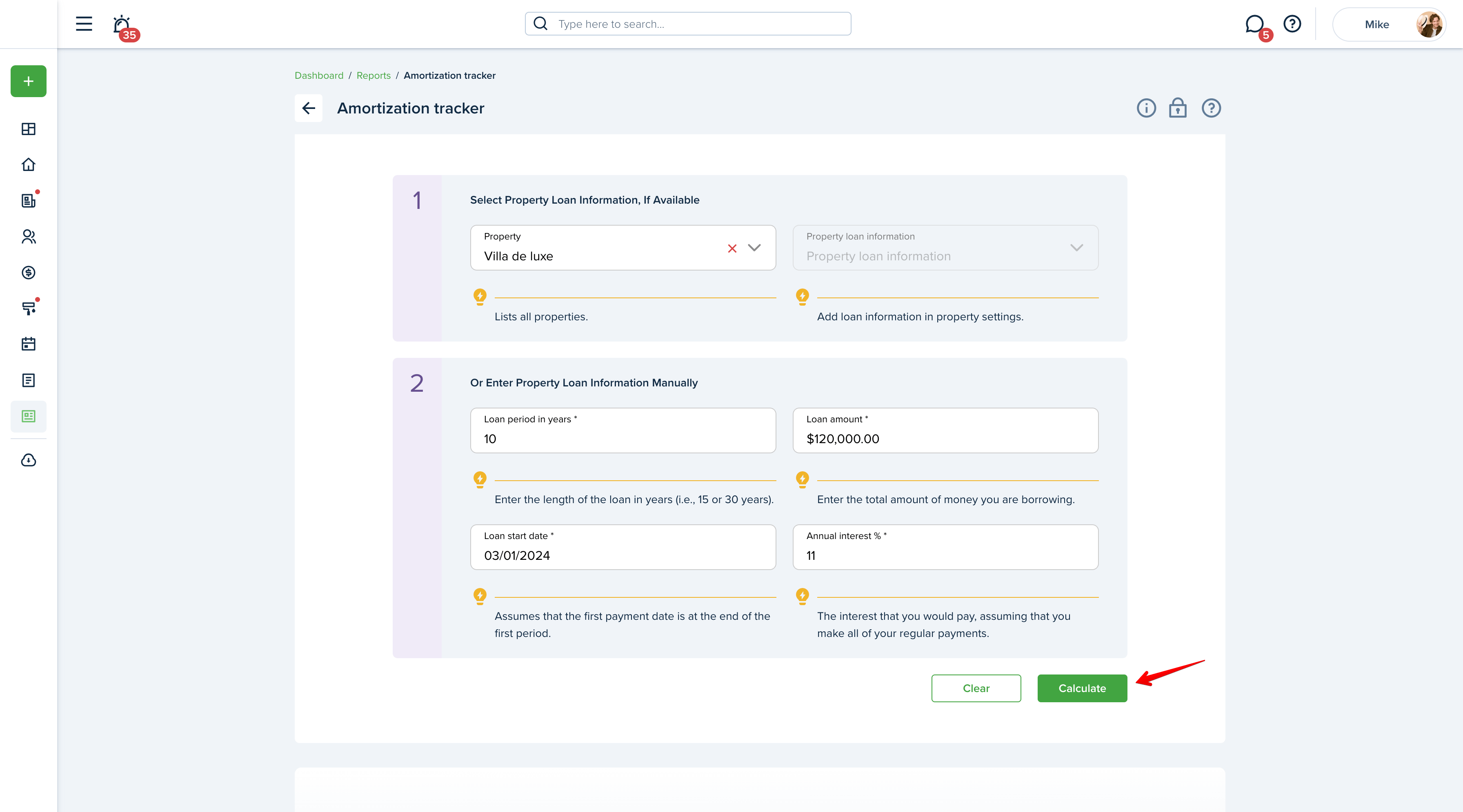

In order to generate the Amortization Tracker, select an available property or enter the data manually.

Select the Property

If you have added the property and its loan information in the property profile, you will be able to select it from the list and all the fields below will be automatically populated with the loan information you have entered in the property profile.

Enter Information Manually

If you haven't added the purchase information while creating the property, you can enter the following information manually: loan period in years, loan amount, loan start date, and annual interest.

Fill in the required fields and press "Calculate."

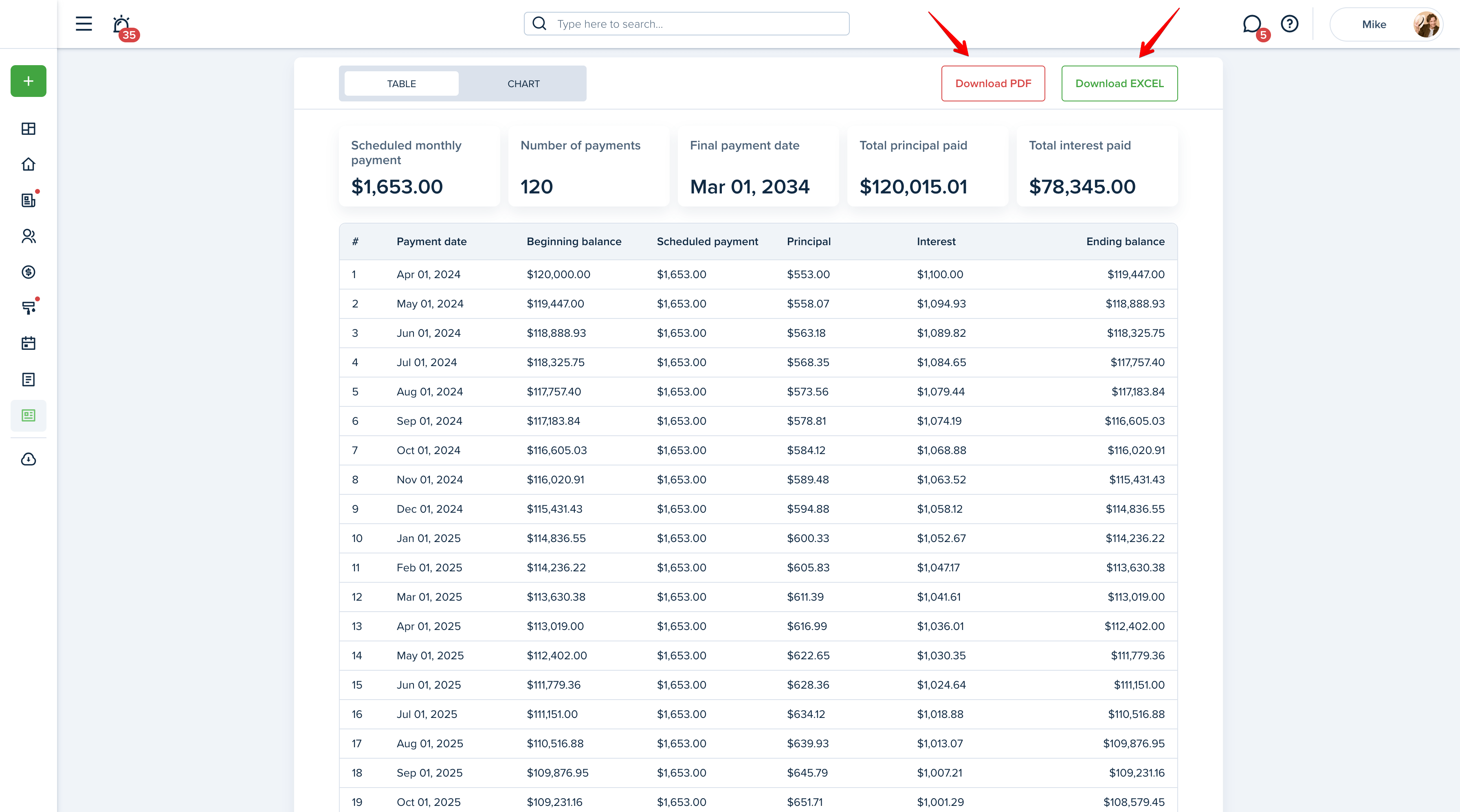

You can view the amortization schedule in a Table or Chart and can download PDF and Excel files of the table or a PDF of the chart:

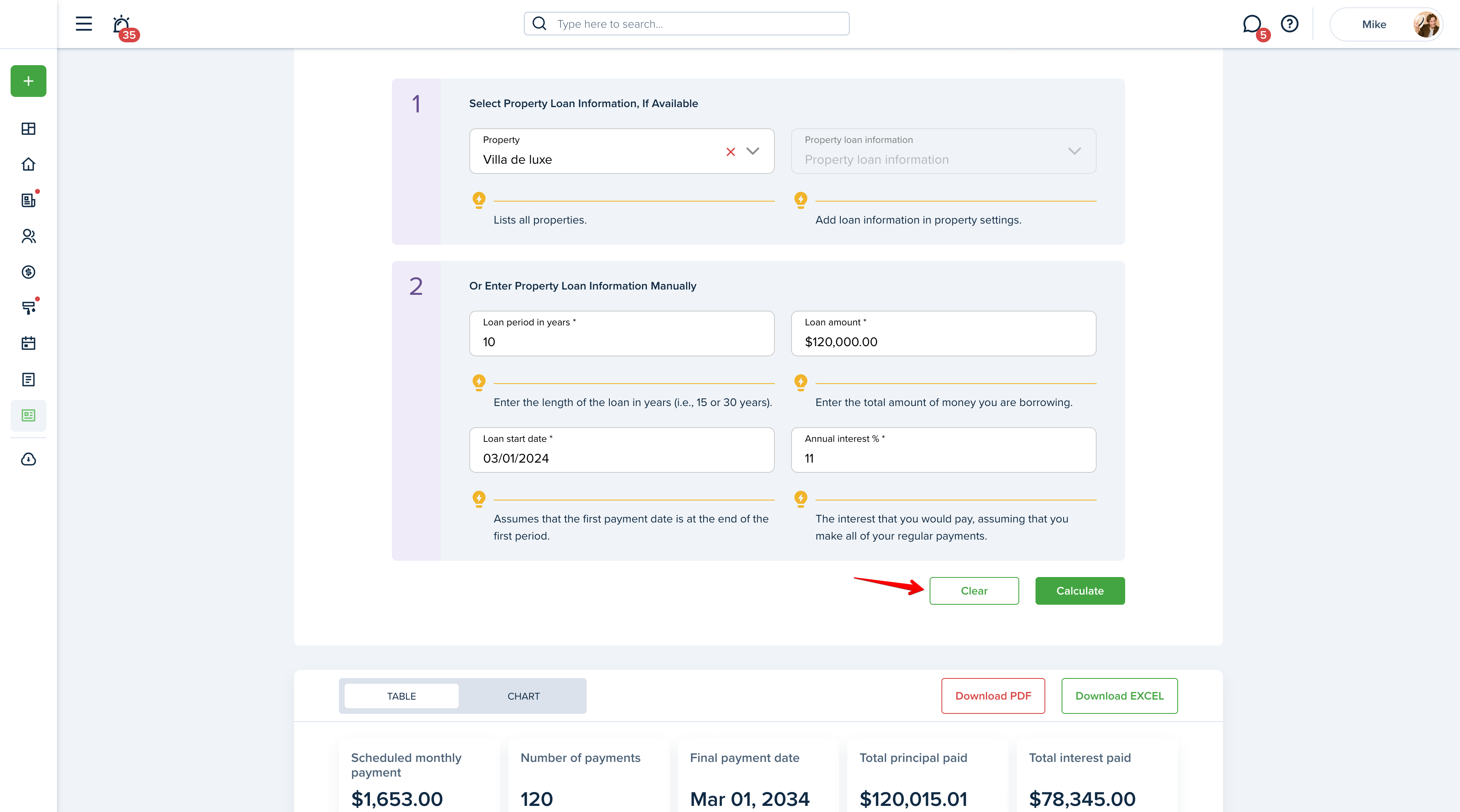

Press "Clear" to start over:

Please note!

The Amortization Tracker does not create any transactions and is not linked to the accounting tool. It is used only to create an amortization schedule based on the loan information entered.

Last updated:

Feb. 20, 2025